Interactive visualization requires JavaScript

Related research and data

Charts

- Affiliation of research teams building notable AI systems, by year of publication

- Annual attendance at major artificial intelligence conferences

- Annual granted patents related to artificial intelligence, by industry

- Annual patent applications related to AI per million people

- Annual patent applications related to AI, by status

- Annual patent applications related to artificial intelligence

- Annual scholarly publications on artificial intelligence

- Artificial intelligence: Performance on knowledge tests vs. dataset size

- Artificial intelligence: Performance on knowledge tests vs. number of parameters

- Artificial intelligence: Performance on knowledge tests vs. training computation

- Computation used to train notable AI systems, by affiliation of researchers

- Computation used to train notable artificial intelligence systems, by domain

- Cumulative AI-related bills passed into law since 2016, as of 2024

- Cumulative number of large-scale AI models by domain since 2017

- Cumulative number of large-scale AI systems by country since 2017

- Cumulative number of notable AI systems by domain

- Datapoints used to train notable artificial intelligence systems

- Domain of notable artificial intelligence systems, by year of publication

- Exponential growth of computation in the training of notable AI systems

- Exponential growth of datapoints used to train notable AI systems

- Exponential growth of parameters in notable AI systems

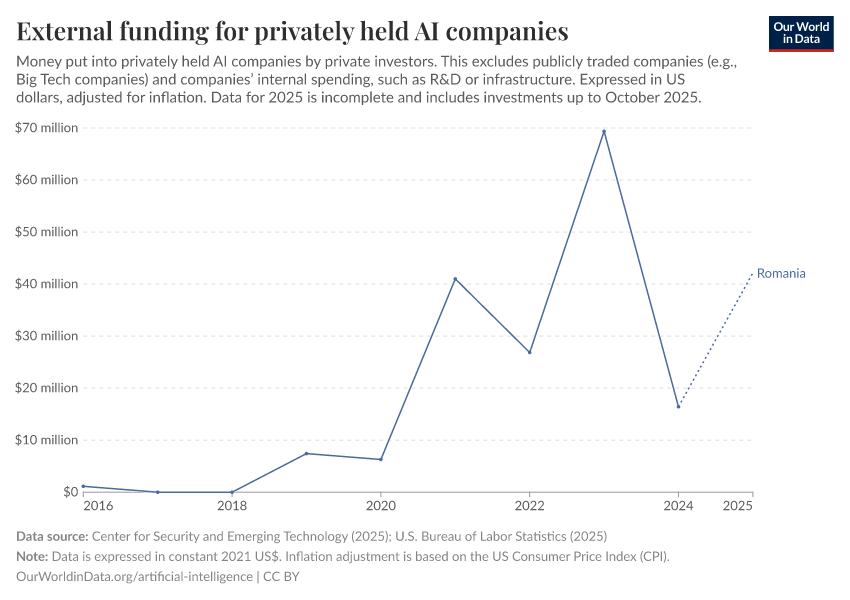

- External funding for privately held AI companies raising above $1.5 millionNetBase Quid

- External funding for privately held generative AI companies

- GPU computational performance per dollar

- Global annual number of reported artificial intelligence incidents and controversies

- Global external corporate deals involving AI companies, by type

- Global views about AI's impact on society in the next 20 years, by demographic group

- Global views about the safety of riding in a self-driving car, by demographic group

- Hardware and energy cost to train notable AI systems

- Highest chess rating ever achieved by computers

- How worried are Americans about their work being automated?

- Market share for logic chip production, by manufacturing stage

- Newly-funded artificial intelligence companies

- Number of large-scale AI systems released per year

- Parameters in notable artificial intelligence systems

- Parameters vs. training dataset size in notable AI systems, by researcher affiliation

- Protein folding prediction accuracy

- Scholarly publications on artificial intelligence per million people

- Share of artificial intelligence jobs among all job postings

- Share of companies using artificial intelligence technology

- Test scores of AI systems on various capabilities relative to human performance

- Total monthly distance traveled by passengers in California’s driverless taxis

- Training computation vs. dataset size in notable AI systems, by researcher affiliation

- Training computation vs. parameters in notable AI systems, by domain

- Training computation vs. parameters in notable AI systems, by researcher affiliation

- Views about AI's impact on society in the next 20 years

- Views about the safety of riding in a self-driving car

- Views of Americans about robot vs. human intelligence