Income inequality before and after taxes: how much do countries redistribute income?

The redistribution of income achieved by governments through taxes and benefits varies hugely.

When interpreting data on inequality, it's important to be clear about what is being measured: inequality of what?1

Usually, it is the inequality of incomes, but even here, there are different concepts to be aware of. The two definitions of income most commonly used are:

- Incomes counted before people have paid taxes and received any benefits from the government;

- Incomes counted after such transfers.

Unsurprisingly, the level of inequality measured before and after tax can differ substantially. The difference reflects the extent of redistribution achieved through a country’s tax and benefits system.2

The chart below shows a measure of inequality – the Gini coefficient – for both definitions of income in the United States. The higher the Gini, the more unequal incomes are. We see that, after taxes and benefits, inequality in the US is reduced substantially: the incomes of poorer households are higher, and the incomes of richer households are lower.

The extent of income redistribution in different countries

The following charts take a look across countries using similar data from another source.3

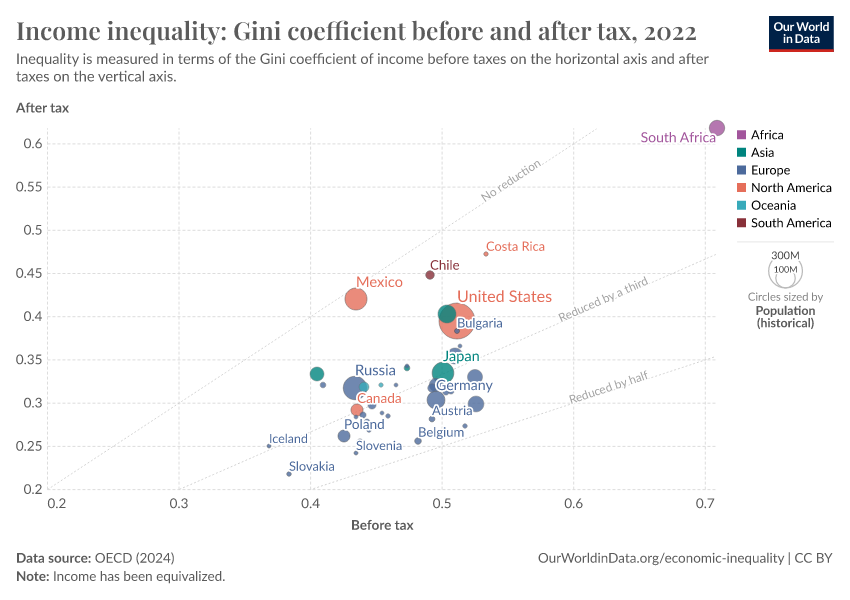

The following scatter chart shows the before-tax and after-tax Gini coefficients in different countries against each other. Three diagonal lines are shown for reference. Along the top ‘No reduction’ line, inequality does not change after redistribution. The further a country falls below this line, the greater the reduction in inequality seen after taxes and benefits. Along the middle reference line, the Gini falls by a third; along the bottom line, it falls by one-half.

We see some correlation between countries’ levels of before-tax and after-tax income inequality. Countries with the highest before-tax inequality tend to be among those with the highest after-tax inequality.

However, the chart also shows the significant variation in the extent of redistribution governments achieve through taxes and benefits. Countries as diverse as Belgium, Spain, Japan, the US, Turkey, and Chile all have similar inequality before taxes – a Gini coefficient of around 0.5. But they achieve very different levels of redistribution. In Chile, taxes and benefits reduce inequality only slightly. In the US, the Gini falls by around a fifth. In Japan, it falls by around a third. In Belgium, inequality is reduced by almost half. Although before-tax inequality is similar in these countries, their levels of after-tax inequality are very different.

The extent of redistribution over time

This chart shows another view on the same data, plotting the percentage reduction in the Gini coefficient that countries achieve through redistribution.4

What the gap between before-tax and after-tax income inequality can and cannot tell us

It is essential to bear in mind that the before-tax distribution of income is already the result of choices made by individuals who take taxes and benefits into consideration. Although before-tax income is sometimes referred to as ‘market income’, it would be wrong to think the way it is distributed reflects market forces alone, as if no government tax-and-benefits policies existed. You may, for example, be reluctant to increase your working hours if you know that doing so would put you in a different tax bracket.

While the change in inequality before and after tax gives us a measure of the extent of government redistribution, it does not tell us the total reduction in inequality caused by this redistribution.

Pensions provide another stark example. In the data above, public pensions are considered part of the redistribution achieved by governments; private pensions are not.5 The incomes of individuals receiving a public pension will be lower before counting these payments. Still, it is not the case that their incomes would be equally low if they lived in a country with no public pension scheme: in this scenario, many of these people would have had private pensions instead.

Another example can be found in the work of Thomas Piketty, Emmanuel Saez, and Stefanie Stancheva (2014), who point to evidence that decreasing top marginal tax rates incentivizes top earners, like CEOs, to bargain more aggressively for higher remuneration, thereby increasing pre-tax wage inequality.6 More generally, taxes and benefits can affect people’s incentives and opportunities in several ways that can shape market outcomes.7

It is also not the case that all redistributive taxes and benefits are reflected in this data. Indirect taxes, such as VAT, are not deducted when measuring after-tax income. VAT is a consumption tax, and some consider such taxes to increase inequality because poorer people spend a higher share of their income on average (or save a lower share).8

Conversely, cash transfers are only one part of how governments spend tax revenue. The provision of public goods contributes substantially to people’s standard of living, and in many cases – such as subsidized housing, public education, or healthcare – it may benefit poorer households disproportionately. As with the data in this article, most estimates of after-tax income inequality do not account for such non-cash or in-kind benefits, given the difficulty of valuing and attributing them to individuals.9

Endnotes

‘Inequality of what?’ is one of a checklist of questions suggested by prominent inequality researchers Anthony Atkinson and Francois Bourguignon (2015). Atkinson AB, Bourguignon F (2015). Handbook of income distribution. Vol. 2A. Elsevier. See p. xxxiv.

As I do in this sentence, ‘before tax’ and ‘after tax’ are often used as shorthands to refer to income measured before or after both taxes and benefits have been paid and received.

It’s worth noting that inequality is sometimes measured according to a concept of income somewhere between these two categories: for example, after taxes have been paid but before benefits are received, or after only some tax and benefits transactions have happened but not others.

The definitions of before and after-tax income in the two data sources relied on in this article – the OECD and the Luxembourg Income Study – are, in general, very similar, and they largely rely on the same household survey data. As such, the estimates are generally very close. There are, however, some discrepancies. For example, the level of before-tax inequality in Finland is much higher in the OECD data than in the LIS data. The OECD provides detailed descriptions of its income concepts and country-level metadata, which you can find on its Income Distribution Database website. LIS provides very comprehensive metadata in its METIS and Compare.it tools.

The reduction in the chart relates to percent, not percentage points, i.e., a reduction in the Gini from 0.4 to 0.3 gives a value of 25%.

This is a simplification. In practice, a binary distinction does not capture the many different types of pensions well. The exact treatment of each kind varies between data sources. A particular outlier is the World Inequality Database, whose concept of before-tax income is measured after the operation of both public and private pension systems. This unusual definition of income is used to yield more consistent comparisons across countries, less impacted by how countries organize pensions. You can explore the WID data and compare it with other sources in the Data Explorers we have collected here: OWID Data Collection: Inequality and Poverty.

Piketty, Thomas, Emmanuel Saez, and Stefanie Stantcheva. ‘Optimal Taxation of Top Labor Incomes: A Tale of Three Elasticities’. American Economic Journal: Economic Policy 6, no. 1 (February 2014): 230–71. Available here.

For a summary focussing on the top of the distribution, see Alvaredo, Facundo, Anthony B Atkinson, Thomas Piketty, and Emmanuel Saez. ‘The Top 1 Percent in International and Historical Perspective’. Journal of Economic Perspectives 27, no. 3 (1 August 2013): 3–20. Available here.

For a discussion of the regressivity of VAT in OECD countries, see Alastair Thomas. ‘Reassessing the Regressivity of the VAT’. Fiscal Studies 43, no. 1 (2022): 23–38. Available from the OECD here.

However, several studies try to estimate the extent of inequality accounting for the distributional impact of such in-kind benefits. See, for example, Paulus, Alari, Holly Sutherland, and Panos Tsakloglou. ‘The Distributional Impact of In-Kind Public Benefits in European Countries’. Journal of Policy Analysis and Management 29, no. 2 (2010): 243–66. Available here.

Cite this work

Our articles and data visualizations rely on work from many different people and organizations. When citing this article, please also cite the underlying data sources. This article can be cited as:

Joe Hasell (2023) - “Income inequality before and after taxes: how much do countries redistribute income?” Published online at OurWorldinData.org. Retrieved from: 'https://archive.ourworldindata.org/20260119-065148/income-inequality-before-and-after-taxes.html' [Online Resource] (archived on January 19, 2026).BibTeX citation

@article{owid-income-inequality-before-and-after-taxes,

author = {Joe Hasell},

title = {Income inequality before and after taxes: how much do countries redistribute income?},

journal = {Our World in Data},

year = {2023},

note = {https://archive.ourworldindata.org/20260119-065148/income-inequality-before-and-after-taxes.html}

}Reuse this work freely

All visualizations, data, and code produced by Our World in Data are completely open access under the Creative Commons BY license. You have the permission to use, distribute, and reproduce these in any medium, provided the source and authors are credited.

The data produced by third parties and made available by Our World in Data is subject to the license terms from the original third-party authors. We will always indicate the original source of the data in our documentation, so you should always check the license of any such third-party data before use and redistribution.

All of our charts can be embedded in any site.