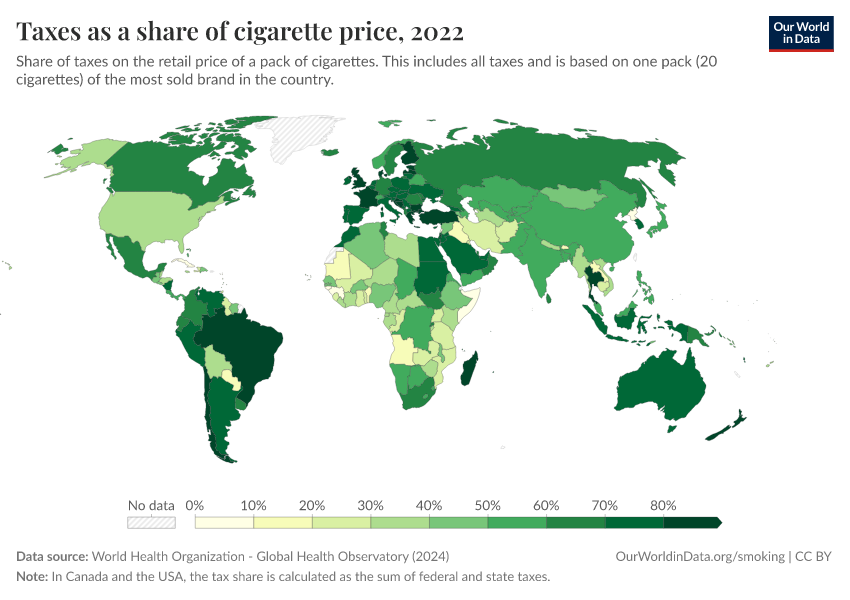

Taxes as a share of cigarette price

What you should know about this indicator

Related research and writing

What you should know about this indicator

Sources and processing

This data is based on the following sources

How we process data at Our World in Data

All data and visualizations on Our World in Data rely on data sourced from one or several original data providers. Preparing this original data involves several processing steps. Depending on the data, this can include standardizing country names and world region definitions, converting units, calculating derived indicators such as per capita measures, as well as adding or adapting metadata such as the name or the description given to an indicator.

At the link below you can find a detailed description of the structure of our data pipeline, including links to all the code used to prepare data across Our World in Data.

Reuse this work

- All data produced by third-party providers and made available by Our World in Data are subject to the license terms from the original providers. Our work would not be possible without the data providers we rely on, so we ask you to always cite them appropriately (see below). This is crucial to allow data providers to continue doing their work, enhancing, maintaining and updating valuable data.

- All data, visualizations, and code produced by Our World in Data are completely open access under the Creative Commons BY license. You have the permission to use, distribute, and reproduce these in any medium, provided the source and authors are credited.

Citations

How to cite this page

To cite this page overall, including any descriptions, FAQs or explanations of the data authored by Our World in Data, please use the following citation:

“Data Page: Taxes as a share of cigarette price”, part of the following publication: Hannah Ritchie and Max Roser (2023) - “Smoking”. Data adapted from World Health Organization. Retrieved from https://archive.ourworldindata.org/20250909-093708/grapher/taxes-as-a-share-of-cigarette-price.html [online resource] (archived on September 9, 2025).How to cite this data

In-line citationIf you have limited space (e.g. in data visualizations), you can use this abbreviated in-line citation:

World Health Organization - Global Health Observatory (2024) – processed by Our World in DataFull citation

World Health Organization - Global Health Observatory (2024) – processed by Our World in Data. “Taxes as a share of cigarette price” [dataset]. World Health Organization, “Global Health Observatory” [original data]. Retrieved February 25, 2026 from https://archive.ourworldindata.org/20250909-093708/grapher/taxes-as-a-share-of-cigarette-price.html (archived on September 9, 2025).