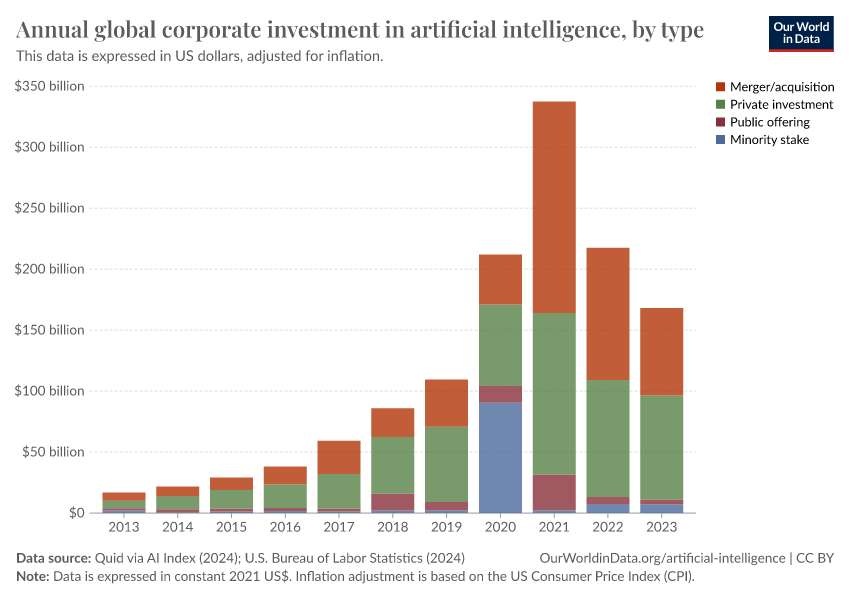

Global external corporate deals involving AI companies, by type

What you should know about this indicator

- This data focuses on transactions involving privately held AI companies,.

- It does not include internal corporate R&D, capital expenditure (CapEx), or public-sector funding. Publicly traded companies, including large tech firms, are excluded.

- Because this data covers only one form of financing, it underestimates total global spending on AI.

- Large single deals can cause spikes in specific years. Broader economic conditions (interest rates, investor sentiment) can also drive changes that are not specific to AI.

- This data includes four types of corporate deals:

- A merger is a corporate strategy involving two companies joining together to form a new company. An acquisition is a corporate strategy involving one company buying another company.

- Private investment is defined as investment in AI companies of more than $1.5 million (in current US dollars).

- A public offering is the sale of equity shares or other financial instruments to the public in order to raise capital.

- A minority stake is an ownership interest of less than 50% of the total shares of a company.

Related research and writing

What you should know about this indicator

- This data focuses on transactions involving privately held AI companies,.

- It does not include internal corporate R&D, capital expenditure (CapEx), or public-sector funding. Publicly traded companies, including large tech firms, are excluded.

- Because this data covers only one form of financing, it underestimates total global spending on AI.

- Large single deals can cause spikes in specific years. Broader economic conditions (interest rates, investor sentiment) can also drive changes that are not specific to AI.

- This data includes four types of corporate deals:

- A merger is a corporate strategy involving two companies joining together to form a new company. An acquisition is a corporate strategy involving one company buying another company.

- Private investment is defined as investment in AI companies of more than $1.5 million (in current US dollars).

- A public offering is the sale of equity shares or other financial instruments to the public in order to raise capital.

- A minority stake is an ownership interest of less than 50% of the total shares of a company.

Sources and processing

This data is based on the following sources

How we process data at Our World in Data

All data and visualizations on Our World in Data rely on data sourced from one or several original data providers. Preparing this original data involves several processing steps. Depending on the data, this can include standardizing country names and world region definitions, converting units, calculating derived indicators such as per capita measures, as well as adding or adapting metadata such as the name or the description given to an indicator.

At the link below you can find a detailed description of the structure of our data pipeline, including links to all the code used to prepare data across Our World in Data.

Notes on our processing step for this indicator

- Reporting a time series of AI investments in nominal prices would make it difficult to compare observations across time. To make these comparisons possible, one has to take into account that prices change (inflation).

- It is not obvious how to adjust this time series for inflation, and our team discussed the best solutions at our disposal.

- It would be straightforward to adjust the time series for price changes if we knew the prices of the specific goods and services purchased through these investments. This would make it possible to calculate a volume measure of AI investments and tell us how much these investments bought. But such a metric is not available. While a comprehensive price index is not available, we know that the cost of some crucial AI technology has fallen rapidly in price.

- In the absence of a comprehensive price index that captures the price of AI-specific goods and services, one has to rely on one of the available metrics for the price of a bundle of goods and services. Ultimately, we decided to use the US Consumer Price Index (CPI).

- The US CPI does not provide us with a volume measure of AI goods and services, but it does capture the opportunity costs of these investments. The inflation adjustment of this time series of AI investments, therefore, lets us understand the size of these investments relative to whatever else these sums of money could have purchased.

Reuse this work

- All data produced by third-party providers and made available by Our World in Data are subject to the license terms from the original providers. Our work would not be possible without the data providers we rely on, so we ask you to always cite them appropriately (see below). This is crucial to allow data providers to continue doing their work, enhancing, maintaining and updating valuable data.

- All data, visualizations, and code produced by Our World in Data are completely open access under the Creative Commons BY license. You have the permission to use, distribute, and reproduce these in any medium, provided the source and authors are credited.

Citations

How to cite this page

To cite this page overall, including any descriptions, FAQs or explanations of the data authored by Our World in Data, please use the following citation:

“Data Page: Global external corporate deals involving AI companies, by type”, part of the following publication: Charlie Giattino, Edouard Mathieu, Veronika Samborska, and Max Roser (2023) - “Artificial Intelligence”. Data adapted from Quid via AI Index Report, U.S. Bureau of Labor Statistics. Retrieved from https://archive.ourworldindata.org/20251118-120813/grapher/corporate-investment-in-artificial-intelligence-by-type.html [online resource] (archived on November 18, 2025).How to cite this data

In-line citationIf you have limited space (e.g. in data visualizations), you can use this abbreviated in-line citation:

Quid via AI Index Report (2025); U.S. Bureau of Labor Statistics (2025) – with major processing by Our World in DataFull citation

Quid via AI Index Report (2025); U.S. Bureau of Labor Statistics (2025) – with major processing by Our World in Data. “Global external corporate deals involving AI companies, by type” [dataset]. Quid via AI Index Report, “AI Index Report”; U.S. Bureau of Labor Statistics, “US consumer prices” [original data]. Retrieved February 24, 2026 from https://archive.ourworldindata.org/20251118-120813/grapher/corporate-investment-in-artificial-intelligence-by-type.html (archived on November 18, 2025).